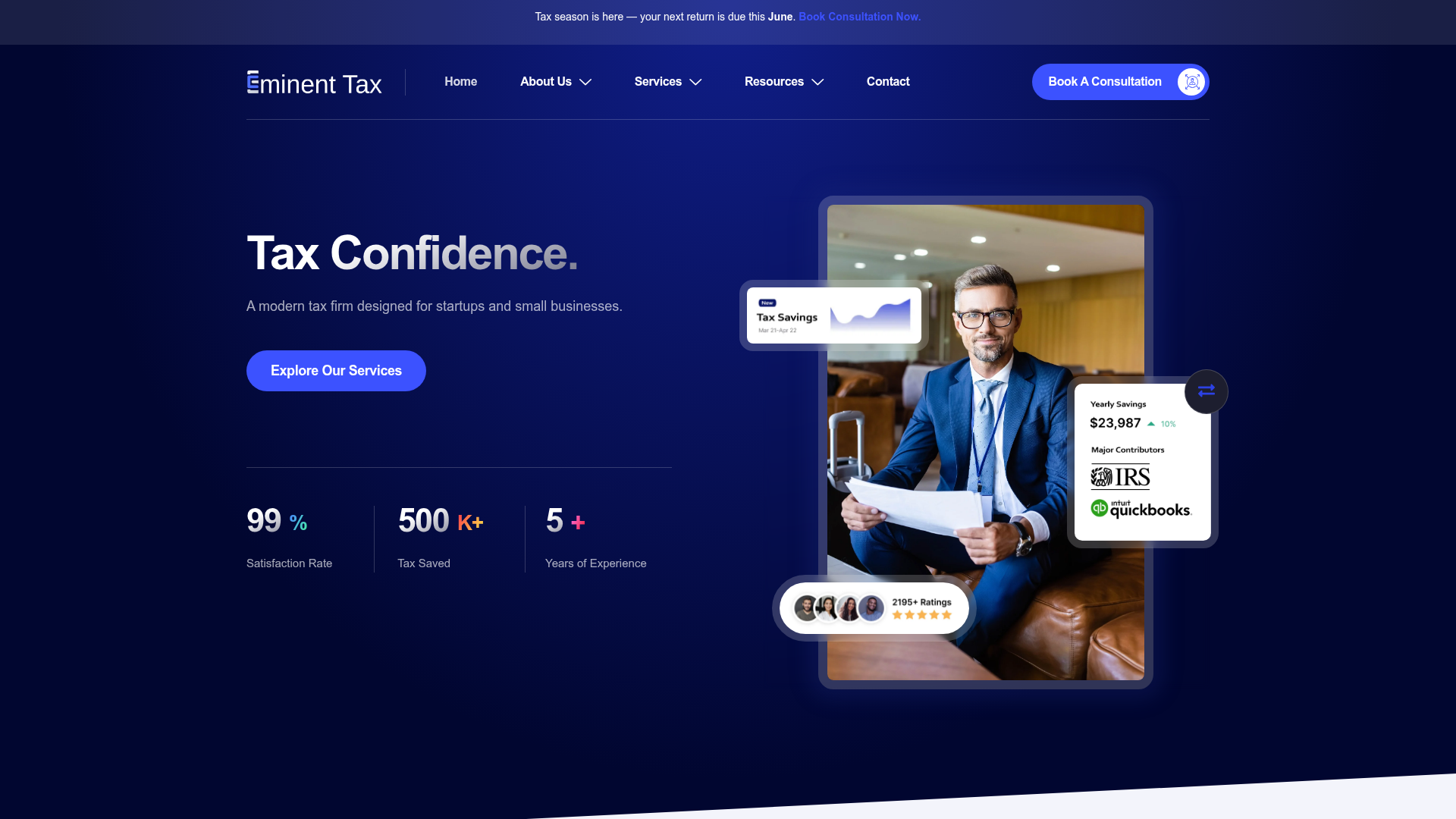

Eminent Tax

Eminent Tax offers accounting services tailored for small businesses and startups, including tax preparation, QuickBooks bookkeeping, and payroll processing. The team focuses on simplifying financial complexities to provide actionable insights, allowing clients to concentrate on their core operations.

Services offered by Eminent Tax

- Bookkeeping Service

This service provides comprehensive QuickBooks bookkeeping to help manage financial records and ensure accurate reporting.

- Accounting Firm

The firm offers a range of accounting services designed to convert complex financial data into actionable insights for small businesses.

- Tax Preparation Service

Expert tax preparation services are available to assist small businesses and startups in navigating their tax obligations efficiently.

- Online appointments

- Wheelchair accessible entrance

- Wheelchair accessible parking

- LGBTQ+ friendly

- Appointment required

Categories

Cities

More local Accountants in Dallas-Fort Worth

View AllWe focus on bookkeeping, payroll, tax consulting and compliance services as well as providing assistance with management consulting. Our experience includes bookkeeping, tax returns filings Federal/State (multiple States) tax advice for individuals and small to medium businesses. We can also assist and represent you with the IRS and sales tax audits. Our services are very cost effective and available 24/7 for our clients.

Business and Tax consultants for small and medium-size business

At Parr & Ibarra CPA, we deliver top-tier accounting and advisory services for individuals, families, and businesses. Our expertise includes Audit & Assurance, Bookkeeping, Business Consulting, Elder and Estate Planning, Family Office, Financial Planning & Analysis, Financial Audits, Outsourced CFO & Comptroller, Payroll, and full-service Tax Planning, Returns (both Personal and Corporate), and Strategies. With a focus on accuracy, transparency, and long-term growth, we’re your trusted partner for financial clarity and success.